Leverage Explained by GF Limited Experts: A Beginner's Guide

(Investorideas.com Newswire) For many people who are new to the world of trading, the term leverage can sound confusing or even intimidating. However, with the right guidance, it becomes much easier to understand. In this article, GF Limited experts break down the basics of leverage in simple terms, making it clear how it works and what beginners should know before using it.

What is Leverage?

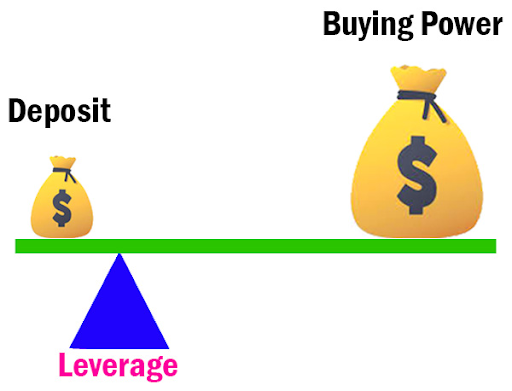

At its core, leverage is like a financial tool that allows a trader to control a larger position in the market with a smaller amount of money. In other words, you can open a bigger trade without needing the full amount of capital upfront.

Think of it as borrowing some additional funds to boost your buying power. For example, if you have $100 and use leverage of 1:10, you could open a position worth $1,000. This gives traders the ability to take part in opportunities that might otherwise be out of reach.

The company explains that although this sounds attractive, it is important to remember that leverage does not create free money. It amplifies both potential profits and possible losses.

Why Do Traders Use Leverage?

Leverage is popular because it makes the market more accessible for people with limited starting capital. Instead of saving up a large amount of money, traders can use leverage to participate in bigger trades right away.

For example:

- Greater market access: A small account can trade larger positions.

- Flexibility: Traders can diversify their strategies more easily.

- Opportunity to learn: Beginners get hands-on experience with smaller funds.

According to GF Limited specialists, this flexibility is one reason why leverage is so widely used in modern trading. However, beginners must use it carefully and avoid rushing into high-risk decisions.

The Risks You Should Know

Leverage can be powerful, but it also carries risk. The same force that increases profits can increase losses, too. This means that small market movements can have a big impact on your account.

Imagine a trade moves against you by just a few points. Without leverage, the loss might be small. But with high leverage, that same movement could lead to a much larger loss. This is why the brand highlights the importance of understanding risk management before using leverage.

Some simple tips include:

- Start with lower leverage ratios.

- Always set stop-loss orders to protect your account.

- Trade with amounts you can afford to lose.

Being cautious is not a weakness; it is part of being a smart trader.

Leverage is a useful tool, but like any tool, it must be handled smartly. For beginners, the key is to focus on learning step by step rather than chasing quick gains. With careful practice, a clear strategy, and proper risk management, leverage can be used effectively.

GF Limited encourages new traders to see leverage not as a shortcut to success, but as a way to expand opportunities while respecting the risks involved. By starting small and building confidence, beginners can grow into more skilled traders over time.